From our experience, e-commerce internationalization is often rushed and not well-thought-out. Do you also plan on selling internationally? Let us show you the 5 most important barriers you will have to deal with in international e-commerce and how to overcome them. Some preparation can work wonders!

Today, selling internationally on the internet is easy-peasy. Most shop-systems offer integrated shipping solutions for the whole EU or even world-wide. Simply translate your online store to English and you are ready to go! Right? Well, not exactly! Offering shipments abroad comes with a whole lot of new risks and responsibilities.

Selling internationally: 5 major obstacles you need to know about:

1. VAT registration overseas

VAT-regulations in the EU are tricky – and the complexity is especially high for businesses that sell cross-border directly to consumers. The good news, however: When you just started selling internationally, you can charge all customers your local VAT rates. E.g. a German onlineshop can charge French customers the German VAT rate.

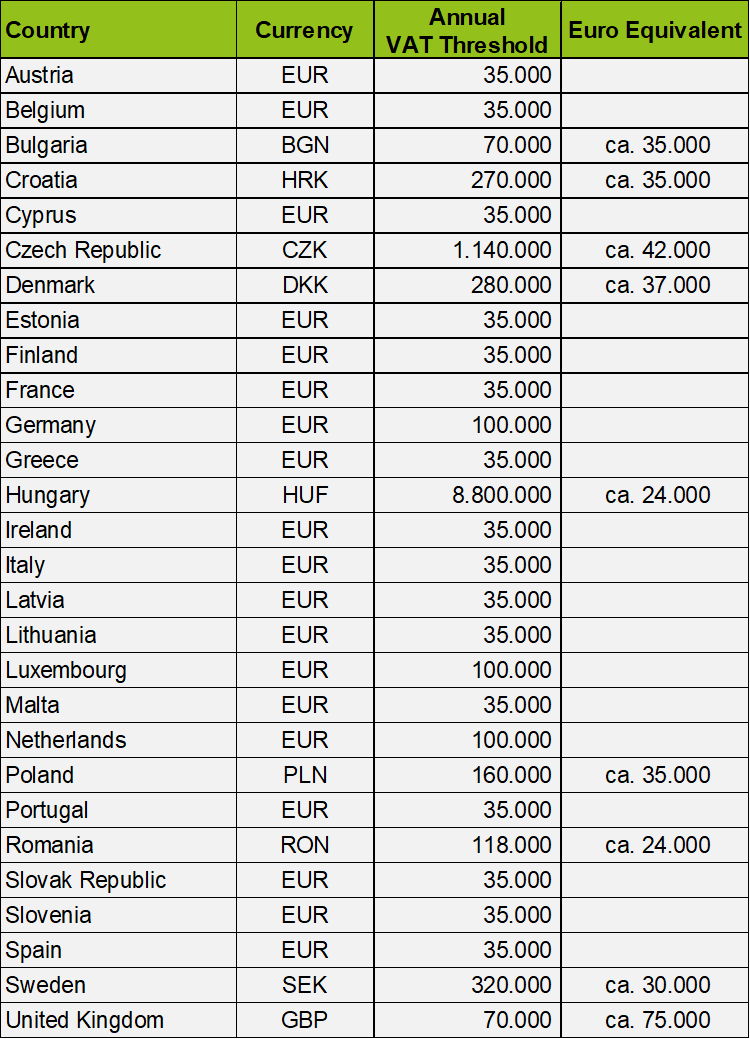

Once your business surpasses any of the EU VAT thresholds, you must register for VAT in these specific countries and charge your customers the local VAT rates. These VAT thresholds differ among EU member states. Although most states currently have a threshold of € 35,000, there are quite a few exceptions. The current EU VAT thresholds are summarized in the table below:

Current overview of annual VAT-thresholds in the EU. (September 2020)

In order to monitor the local VAT thresholds at all times, we recommend using the hellotax SaaS platform from the start. The VAT-software itself is free to use. Once you surpass a VAT threshold, you can easily purchase the required services, such as VAT registration or filing the local tax reports. Due to our partnership with hellotax we can offer exclusive discounts. Be sure to check out our partner offers for your hellotax discount voucher as well as many other essential tools and services for selling overseas in e-commerce.

Note: This paragraph on EU VAT registration is written from an EU-perspective. If your business is located outside the EU and you sell internationally to customers within the EU, different rules may apply. We recommend consulting with your tax advisor or to contact hellotax directly.

2. Waste & packaging legislation

Other than VAT, there are often no thresholds for packaging or waste registration in the EU. This means that you should analyze your legal obligations regarding product- and packaging waste recycling before being active in a country. Extended Producer Responsibility demands manufacturers, importers, or retailers of (packaged) goods to contribute to the waste management, i.e. pay a fee for recycling.

Due to the EU packaging waste directive, each member state has introduced different waste laws, institutions, and recycling schemes. And some non-EU states have similar legislation, too. This makes the research for businesses that sell internationally extremely difficult. To avoid spending too much time and money on the research for each of your target markets, we offer a digitized compliance consulting service from only €19.99 per country. You will also get notified about any changes, so that your business stays compliant in the future. And on top of that, we offer a premium service that is ideal if you have no internal capacities and want to outsource packaging compliance altogether.

Besides packaging, businesses selling electronics, batteries, or in France even textiles or furniture, need to register with recycling schemes as well. Furthermore, there are specific labelling obligations for certain products when selling internationally. We have summarized some in this article:

3. Payment options

Customers in every country prefer different payment methods. Germans, for instance, are quite conservative. They tend to use ‘classic’ methods such as SEPA bank transfer or to buy on account or pay on delivery. Customers in the UK, on the other hand, prefer to pay by credit card. PayPal has become an internationally accepted payment method in e-commerce and may be a good compromise. But is this true?

Before selling internationally, you should definitely do some research on the preferred payment methods of your customers. The Worldpay Global Payments Report can be of help, as it lists the preferred payment methods of each country. Do not underestimate the importance of this research. Offering the wrong payment options is still one of the most common reasons for customers to abandon a purchase.

4. Legal documents in foreign languages

Translating an onlineshop is one thing, but translating legal documents? That is a whole different level, as simple mistakes can become very expensive. But do you even need legal documents in foreign languages? Are the legal documents in the language of where your business is located not enough?

The short answer: If an onlineshop is accessible in different languages, the legal documents are also required in those languages. And if your onlineshop is not available in at least English, you will probably not be selling a lot internationally. Especially English, French, and Spanish are languages that are commonly spoken in many countries. Thus, it may make sense to localize your shop in these languages.

Since translations by a lawyer are usually very expensive, we recommend using the legal documents in foreign languages from Händlerbund. These include the legal notice, general terms and conditions, or data privacy statements. All documents are available in several foreign languages, including German, English, French, and Spanish. Händlerbund also helps e-commerce businesses with legal issues in general. Using our voucher code P2312#2020, you save 3 months on all membership packages of Händlerbund.

5. International logistics

Shipping to customers of your own country is easy, because you know the best CEP (courier-express-parcel) service providers. You have experience either as a retailer or as a customer. But when selling internationally, the number of providers increases, and your local providers may not necessarily be the best choice. Who is the best CEP provider in which country? What are the differences between providers regarding price, delivery times, and reliability? What are the terms of delivery, and how do they handle returns?

From experience, the differences between countries are vast. Extensive research is necessary to successfully internationalize your e-commerce business. You will probably need to work with different CEP providers in different countries. This is crucial, because your customers will only be satisfied if you can offer acceptable delivery times and prices.

Collaborating with a fulfillment service provider can be helpful, especially if they have long-term experience in international e-commerce. Onefulfillment, for instance, offers a full-service package, where they handle your storage, international shipping, and processing of returns. You will also profit from their network of international CEP providers. Use our voucher ecosistant2020 to save 3 months of storage costs.

Pro-tip: Mention the delivery times and rates for each country on your website for transparency.

Be well-prepared before selling internationally online

You should do an in-depth market analysis of your target countries before selling overseas. Use the “Ease-of-doing-business”-index or the Google Market Finder to identify the best markets for your expansion. Both are available for free. Generally, less is often more: We recommend focusing on your core markets at first. Those are the ones where – according to your research – you will have an advantage and can easily realize sales from the beginning. Afterwards, expand your business step-by-step, country-by-country. This way, you can ensure to always be compliant with the laws and offer your customers the best possible service.

Our service can help you fulfill your legal obligations from packaging laws, and even identify countries where your business is exempt of obligations. Among our partner offers, you will also find more tools and services to build your online store and expand it internationally.

If you have any questions, do not hesitate to contact us, or read through our FAQ section.

More relevant articles for you:

Sustainability in e-commerce – 5 things that environmentally conscious customers expect